What is my trading style? How do I find it?

Your trading style has a lot to do with your life style and what makes you happy or energized. For some people that’s sitting in front of the screen all day looking for short term imbalances from candidate stocks or futures and grabbing a few ticks and then the occasional run that lasts the entire morning or day.

Maybe it doesn’t matter to them that one day they are trading Tesla, then the next day Gold futures, so long as it meets their criteria for a candidate stock or futures contract and they can apply their developed craft.

For others the thing that may energize them is researching a company, understand their position in the market, know the daily patterns of volume, and live for frequent press releases that always bring an opportunity. Or, maybe it’s earnings plays or economic reports, or capturing breaks from the opening range, or any number of the unlimited strategies that can be employed.

In terms of timeframe, you could decide that’s your thing. Maybe you only do scalping or short term imbalances, and want to be flat at the end of the day. A classic day trader. You look for candidate stocks for that day, or what some call stocks in play, because they represent the best opportunities, and attack them with ebullience and vigor, because that’s what makes you happy, keeps you energized.

Maybe you’re a swing trader, and enjoy capturing the pivots of an asset over longer periods of time. You get a charge out of analyzing the flow of interest coming in and out of an asset, your a solid analytical thinker, or find edge in news worthy events. Perhaps you’ve identified a weakness in a trend, or you look for big events that have follow through, or economic cycles.

Maybe you’re a swing trader, and enjoy capturing the pivots of an asset over longer periods of time. You get a charge out of analyzing the flow of interest coming in and out of an asset, your a solid analytical thinker, or find edge in news worthy events. Perhaps you’ve identified a weakness in a trend, or you look for big events that have follow through, or economic cycles.

The facts are that you can make money in any timeframe, you just need to hone your craft, love what you do, make it your passion to perfect your process and technique, and every day you do it give you the energy to want to improve and do it more.

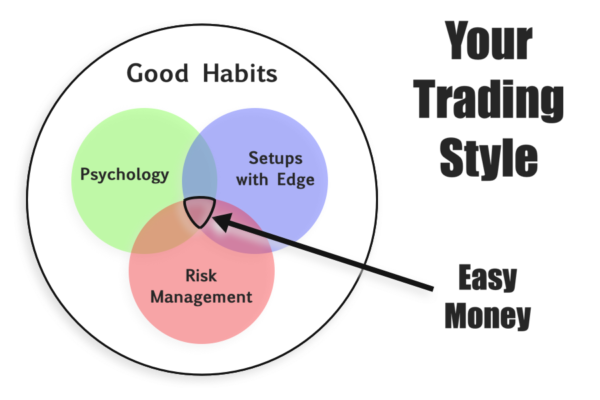

What you’ll need to do is get skin in the game with setups that have edge, employing many different strategies, timeframes and techniques. Find out what works for you, find out what gives you a charge…and makes you want to do more. It comes down to experience with things that have edge…this is important. Don’t think your going to take down the market just because you love that particular stock or setup…if it doesn’t have real edge, you’re not going to be successful.

I will say this, if you’re up in the air of which style of trading to go with, consider this…most successful traders employ many different styles, short term, day trading. Medium term swing trading and longer term position or trend trading. The vast majority of successful traders find more success on the longer timeframes, that’s just a fact. But even the long term traders won’t pass up an opportunity to beat the market if they can scalp some easy money.

The goal here, is that you want to be happy, you want to be consistently profitable, you want to only trade things with edge, you want to perfect your process, and develop all the right habits. You want all these things, and when you’ve found them, then that’s your style.

The follow up question is this…what will it take, when will I get there? Seems like a lot of work.

It absolutely is. Trading isn’t for everybody, not everyone is cut out to be a trader. There’s no doubt that your dedication and discipline and effort are absolutes. But you also need the right tools, technology, information, coaching, mentoring and most of all…it takes time to develop, before you will reach that goal of becoming a consistently profitable trader.

Check out out Trader Master Course, it’s a great start.

How do you find or develop an edge for trading? Is it something ‘you are born with it or not” or you can develop by learning or it is out there and you just have to search and find it?

Thanks

You can either co-opt a trade from someone that has already found a verifiable edge in the market, or you can do the hard work yourself, to discover and prove that there’s an edge you can exploit…quite frankly it comes down to hard work, because even if you co-opt it, you still have to develop the discipline to realize that edge.